Tomcat

Professional

- Messages

- 2,688

- Reaction score

- 1,015

- Points

- 113

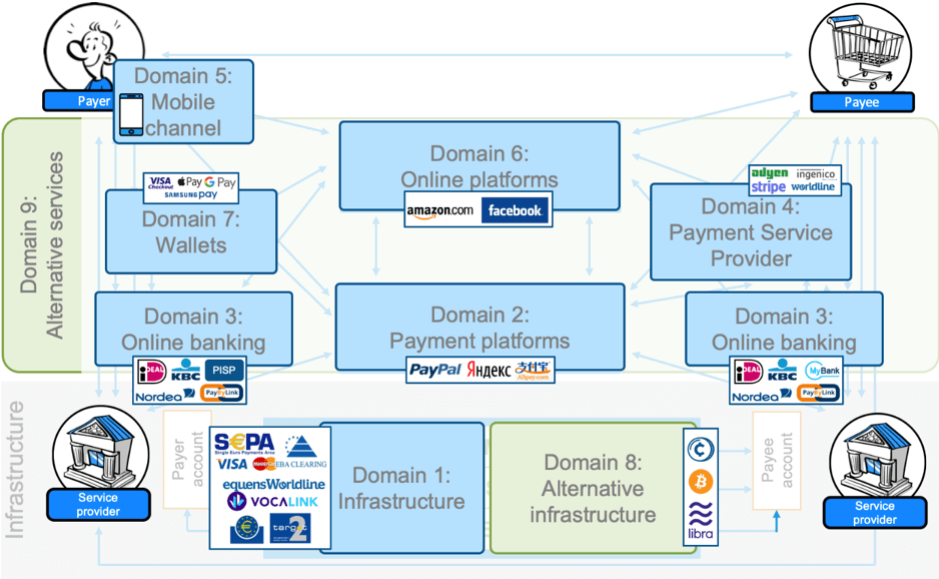

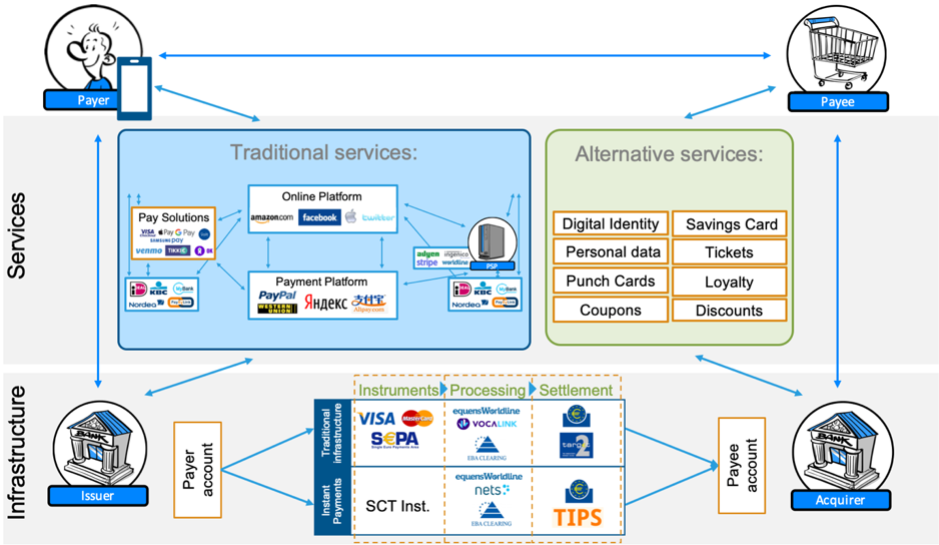

Do you know how the world of payments works, and who is who in this entire large ecosystem?.. Today we are publishing a translation of an article by Innopay analysts dedicated to mapping the key players in the space of those who, with their IT infrastructure, help buy and sell online. Infographics are attached - everything is at a glance.

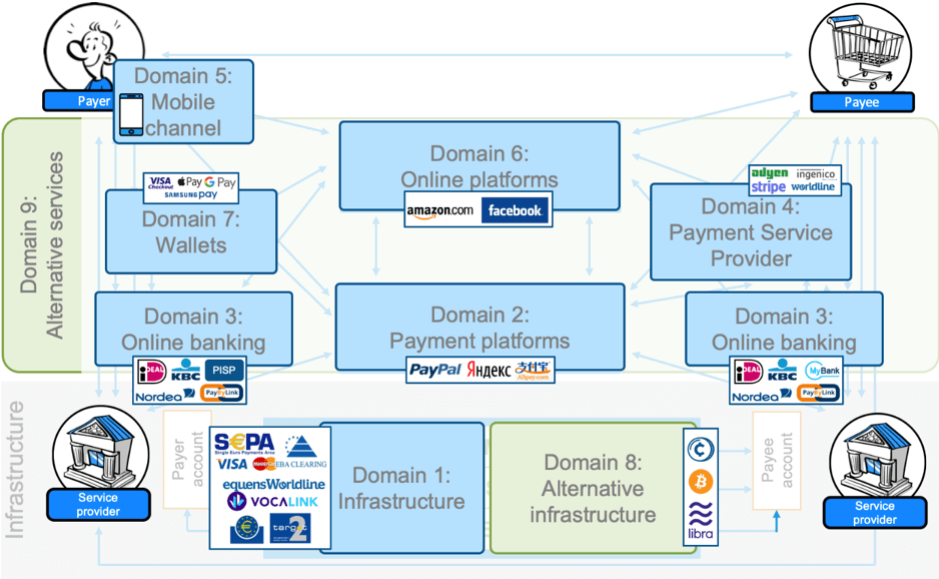

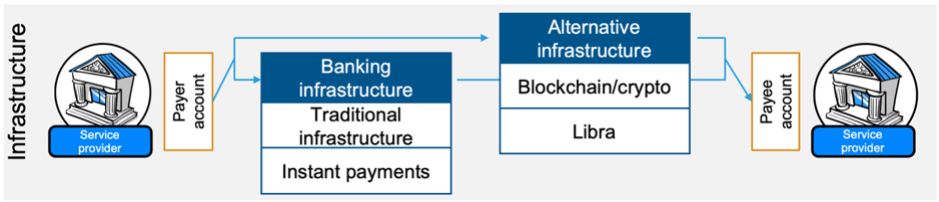

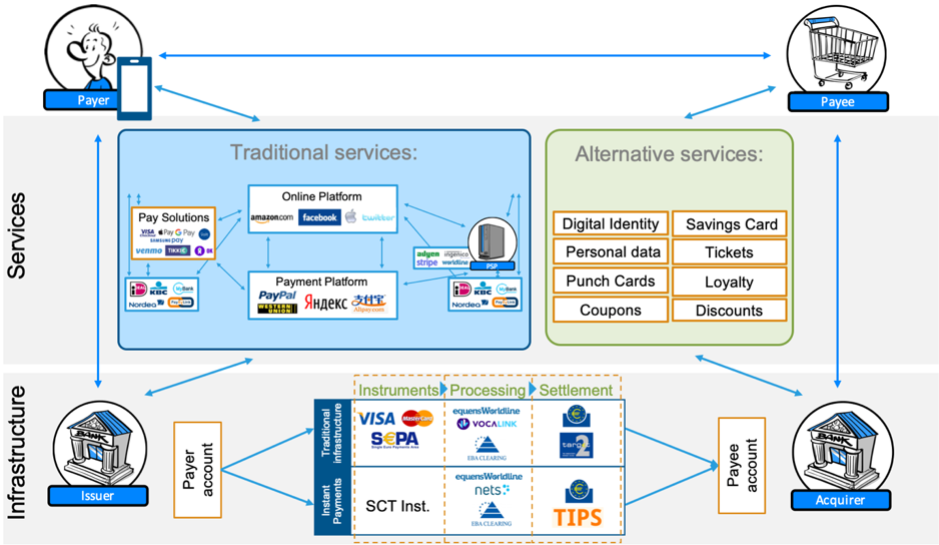

The speed and capabilities of Internet connections are growing, the variety of payment services is increasing - all this leads to the fact that the payment system continues to transform. As a result, new “areas” are added to the existing “landscape”. For example, alternative layers are being introduced into the infrastructure, and the list of traditional services is being replenished with new payment services.

Rice. 1 - Interconnected areas in the payments ecosystem

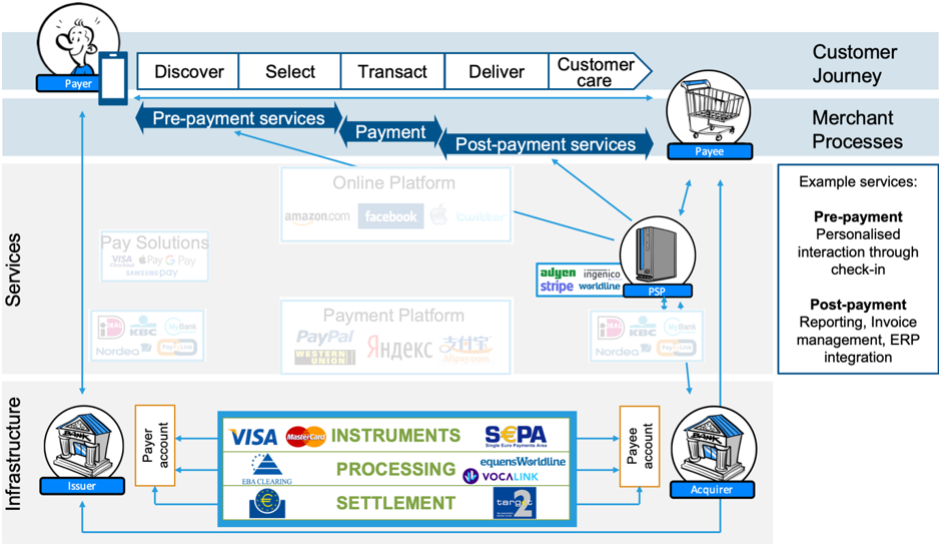

Fig. 2 - Traditional infrastructure is supplemented with new elements

If the infrastructure of a traditional payment system is designed for batch processing and implies time restrictions (for example, processing stops after 17:00 or on weekends), then the growing instant payment system is capable of transferring the necessary funds to in real time and, if possible, on a 24/7 basis.

The move to instant payments modernizes systems, reduces costs and enables new services, making it easier to process transactions 24/7 and 365 days a year. To date, more than 45 countries have already switched to the fast payment system and about 25 more are in the process of switching to them.

The gradual transition to real-time payments is a phenomenon that is more than ten years old (for example, the UK's Faster Payments system was launched in 2008). However, the recent launch of the European SEPA SCTInst (Instant Credit Transfers) scheme and SWIFT GPI service has marked a significant development towards cross-border payment services. Instant payments represent an important development in Europe as a key strategic element in response to the dominance of card schemes and the growing popularity of alternative payment networks.

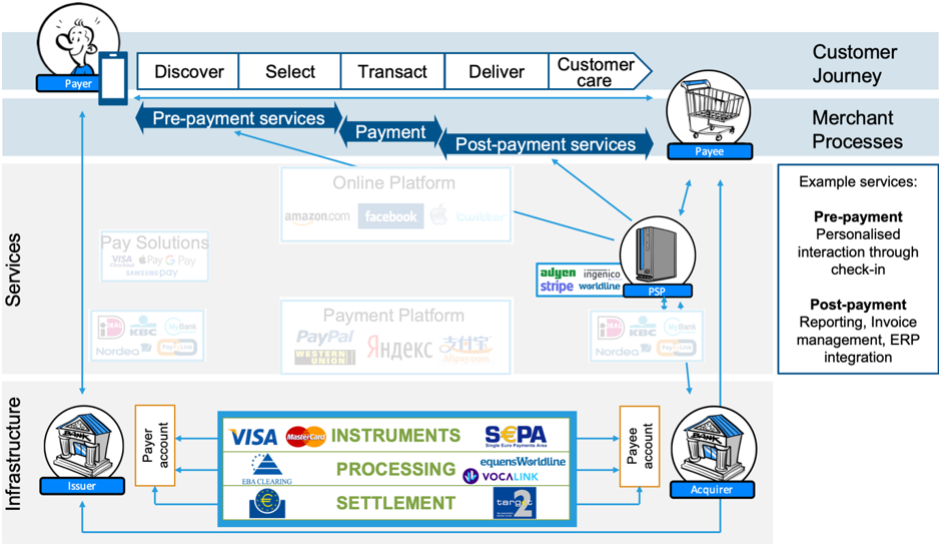

Fig. 3 - Payment platforms manage payment and delivery for multiple “purchase” flows.

The functionality of payment platforms allows you to support a wide variety of types of payment transactions, for example, peer-to-peer payments through Yandex.Money and PayPal consumer lending.

Along with functional developments, there is a consolidation of platforms to increase the reach and volume of payment solutions (for example, PayPal acquired the Chinese company GoPay to expand its presence in the Chinese market and increase its relevance to Chinese merchants). Increasing competition between platforms is driving this consolidation and blurring the boundaries. To stay in business, market players choose different strategic paths - expanding their geographic presence, specializing in specific business segments, or expanding their portfolio with additional services (more details in the 4th area).

An important addition is the introduction of the ability to allow third parties to securely use bank interfaces, as required by the revised Payment Services Directive (PSD2). Banks are required to provide at least one interface to facilitate the initiation of payments by licensed third parties. These third parties, in turn, require a specific PSD2 Payment Initiation Service Provider (PISP) license regulated under PSD2.

Other developments in this area are improving the customer experience for both non-banks and banks, as shown in Figure 4. Banks are now developing their monobank solutions with enhanced capabilities, such as peer-to-peer (P2P) payments.

Another notable development is the use of OBEP at physical points of sale (POS) - banks and non-banks are developing proposals to enable POS payments through a mobile banking application. For example, developing proposals for POS payments using QR codes that can be scanned through the company's mobile application.

Fig. 4 - Peer-to-peer systems simplify the payment experience of buyers

The payment services market for basic payment transaction processing services is developing rapidly. This is evidenced by the growing cost pressures facing hundreds of existing services. Staying on top of the ever-changing needs of buyers and sellers isn't easy. Payment aggregators are choosing different strategic paths to cope with changing market dynamics:

There is also an entry into the market of new players who own diverse portfolios of services from various global payment services, that is, in fact, aggregators of such services. The services provided usually include optimized payment routing (selection of the most suitable payment service for a particular payment), visualization and analysis of key indicators.

Fig. 5 - Growth strategy - study of pre- and post-payment services before, during and after payment

The focus of users on mobile services has led to an increase in the number of competing banks paying special attention to mobile channels. Banks like N26, Revolut and Bunq do not have physical offices, providing almost all banking services exclusively through apps.

Fig. 6 - Traditional channels are being replaced by new, exclusively mobile channels

The next part of the translation examines online platforms (GAFA - Google, Apple, Facebook, Amazon and BAT - Baidu, Alibaba, Tencent), wallets, cryptocurrencies and new services.

We continue to understand the multi-layered infrastructure of the payment landscape. The first part was devoted to instant payment systems, payment platforms, online banking, payment acceptance services and the mobile revolution.

Today this means online platforms (Google, Apple, Facebook, Amazon + Baidu, Alibaba, Tencent), wallets, cryptocurrencies and new services. Let's start!

Globalization provides consumers with the ability to pay beyond their geographical borders. Online platforms offer services that make it easier to connect to payment systems outside the buyer's region (for example, Alipay offers its e-wallet to non-Chinese customers to simplify financial transactions in Chinese markets).

Presence in every aspect of a consumer's daily life provides a rich flow of data, allowing the creation of sophisticated payment solutions tailored to the customer's needs outside of the normal purchasing process. Providing payment services to its customers, in turn, gives the platform greater access to customer data and expands its ability to provide new value-added services.

Figure 7 - What position will online platforms take in the financial system and how will it affect the role and relevance of traditional payment institutions

The growth of P2P payments was relatively slow at first. Consumers were reluctant to pay for this type of service, comparing it to payments through OBEP or payment platforms, which are considered practically free. However, P2P payments are growing in popularity as service providers cut their own fees. This effect is achieved due to the fact that, as a marketing ploy, suppliers take on transaction costs and thereby stimulate users to switch to a new platform.

On the path to a profitable business model, service providers are looking to move their free B2C solutions into the C2B space by offering paid services to business clients. One example is US P2P payment solution Venmo (owned by PayPal), which began by absorbing transaction costs to build a user base. The company now earns revenue from purchases from approved online retailers, which are charged a commission.

PSD2 allows consumers to initiate payment from a licensed third-party application. This model is developing in the wallet direction, where in one application the buyer can pay from different accounts. However, the lack of standardization of PSD2 interfaces between banks at a European (and often national) level slows down the work of service providers wishing to offer such “wallet” solutions for payment accounts, as it increases the cost, complexity and implementation time to ensure high coverage. In an attempt to compensate for all these difficulties, various technical service providers are emerging who care about the possibility of such connectivity.

Recent developments in wallets are merging payments with non-payment services, such as in-app storage of loyalty and discount cards (eg OK and Reward Cards). This further simplifies the consumer experience beyond payments. Such developments in the field of non-payment services are revealed in the 9th area.

Figure 8 - Payment solutions go beyond card payments while simplifying processes

Non-traditional players are introducing alternatives to the existing payment infrastructure, creating a system in which service providers exchange valuable information on behalf of the payer and recipient across various payment infrastructures (as shown in Figure 9). All this happens for several reasons: for example, to reduce dependence on traditional financial players, benefit from existing functionality and increase the speed of innovation.

Figure 9 - The infrastructure is managed by "service providers" in the payer and recipient area (as opposed to traditional issuers and acquirers)

Alternative payment infrastructure based on blockchain and cryptocurrency has been around for several years. It has proven useful on occasion (such as the recent hyperinflation of Venezuela's national currency), but its general acceptance as a payment mechanism for everyday purposes has been slow. As a recent example, consider the Libra consortium, an alternative payments infrastructure that is currently under scrutiny by governments and central banks due to its disruptive potential for the traditional financial system (along with security and governance issues). At the same time, regulators are also developing their own alternative infrastructure projects. Thus, in response to the introduction of Libra, the National Bank of China is accelerating the development of the digital yuan (DECP). DECP offers "controlled" anonymity and functionality to replace paper money. Opinions vary on the viability of alternative payment infrastructures and the demand for them, and we are expected to see real potential for such infrastructures in the near future.

In search of new business models, financial institutions have found new uses for their payments infrastructure. Their interconnected network of trusted and regulated organizations specializing in the exchange of structured data proves useful for various types of services beyond payments.

Examples of how existing payments infrastructure can be used for other applications and services include transferring personal registration or login data through third-party applications (for example, BankID schemes), and combining payments with other data streams, such as e-invoicing or loyalty and discount schemes. Other alternative services include lending services offered to both consumers (eg Payu) and businesses (eg PayPal). By using the payment history of buyers and sellers for profiling and scoring, players like Amazon and Paypal can provide instant lending services to facilitate payment transactions.

By accelerating these processes, PSD2 simplifies access to payment infrastructure for non-financial institutions and ensures seamless integration of payment systems with alternative services.

Figure 10 - Emergence of alternative services in addition to existing services and infrastructure

PSD2 is a key factor in the development of several of the described regions. Recent years for PSD2 have been spent in discussions about technology standards and have delayed the implementation of regulatory technology standards. A key theme of PSD2 is Strong Customer Authentication (SCA), which impacts a variety of purchasing scenarios. The next decade will tell whether the innovative potential of PSD2 will be realized.

The financial system in Europe is still heavily dependent on traditional card schemes and is under increasing pressure from tech giants (GAFA and BAT) as they try to expand their influence. The global payments landscape is truly undergoing a transformation. Major technological advances, regulatory reforms and increasingly new initiatives coming from global digital platforms in particular have led to significant changes. These developments put significant pressure on banks and payment services to take action.

Finally, one interesting recent development worth following is the launch of PEPSI (Pan-European Payment Systems Initiative). PEPSI is an initiative aimed at developing a pan-European retail payments solution that can compete with card schemes and tech giants. It is supported by the twenty largest European banks, as well as the ECB. In the future, this initiative could be an important development that will influence the further development of the payments landscape. However, an important success factor will be whether the players involved are willing to take an organized and collaborative approach to creating a pan-European alternative for domestic (card) payment schemes across Europe.

(c) Original author: Anda Kania

Nota bene: some of the developments mentioned in the article relate to the European payment market and are not (yet) directly related to Russia. However, we hope that the translation of this article can still be useful to you.

The speed and capabilities of Internet connections are growing, the variety of payment services is increasing - all this leads to the fact that the payment system continues to transform. As a result, new “areas” are added to the existing “landscape”. For example, alternative layers are being introduced into the infrastructure, and the list of traditional services is being replenished with new payment services.

Rice. 1 - Interconnected areas in the payments ecosystem

Area No. 1: Digitalization of payment system infrastructure

Infrastructure includes:- “instruments” that initiate money transfers (for example, using cards or SEPA Credit Transfers (SCT) - credit transfers within the single euro payment area),

- “processing” - payment processing, consisting of netting and clearing,

- and “settlement” – the transfer of funds through central banks.

Fig. 2 - Traditional infrastructure is supplemented with new elements

If the infrastructure of a traditional payment system is designed for batch processing and implies time restrictions (for example, processing stops after 17:00 or on weekends), then the growing instant payment system is capable of transferring the necessary funds to in real time and, if possible, on a 24/7 basis.

The move to instant payments modernizes systems, reduces costs and enables new services, making it easier to process transactions 24/7 and 365 days a year. To date, more than 45 countries have already switched to the fast payment system and about 25 more are in the process of switching to them.

The gradual transition to real-time payments is a phenomenon that is more than ten years old (for example, the UK's Faster Payments system was launched in 2008). However, the recent launch of the European SEPA SCTInst (Instant Credit Transfers) scheme and SWIFT GPI service has marked a significant development towards cross-border payment services. Instant payments represent an important development in Europe as a key strategic element in response to the dominance of card schemes and the growing popularity of alternative payment networks.

Area #2: Platforms on top of the payment infrastructure

The second area is payment platforms, which are responsible for the convenience of the “purchase” stage of the buyer’s journey. In addition to initiating a remittance using connected traditional payment instruments, payment platforms allow for various variations of the “payment transaction trinity” of agreement, payment, and delivery step—as shown in Figure 3. Although agreement and delivery are not typically part of the actual payment, payment platforms provide increasingly greater control over timing, payment and delivery to ensure the security of the transaction between payer and recipient. This could be, for example, withholding payment to the seller until the goods are delivered to the buyer.

Fig. 3 - Payment platforms manage payment and delivery for multiple “purchase” flows.

The functionality of payment platforms allows you to support a wide variety of types of payment transactions, for example, peer-to-peer payments through Yandex.Money and PayPal consumer lending.

Along with functional developments, there is a consolidation of platforms to increase the reach and volume of payment solutions (for example, PayPal acquired the Chinese company GoPay to expand its presence in the Chinese market and increase its relevance to Chinese merchants). Increasing competition between platforms is driving this consolidation and blurring the boundaries. To stay in business, market players choose different strategic paths - expanding their geographic presence, specializing in specific business segments, or expanding their portfolio with additional services (more details in the 4th area).

Area No. 3: Online banking of electronic payments (OBEP)

The development of banks and banking communities offering Internet banking services for electronic payments from one bank account to another is all about area 3. In general, there are two types of OBEP solutions: monobank solutions and multibank schemes.An important addition is the introduction of the ability to allow third parties to securely use bank interfaces, as required by the revised Payment Services Directive (PSD2). Banks are required to provide at least one interface to facilitate the initiation of payments by licensed third parties. These third parties, in turn, require a specific PSD2 Payment Initiation Service Provider (PISP) license regulated under PSD2.

Other developments in this area are improving the customer experience for both non-banks and banks, as shown in Figure 4. Banks are now developing their monobank solutions with enhanced capabilities, such as peer-to-peer (P2P) payments.

Another notable development is the use of OBEP at physical points of sale (POS) - banks and non-banks are developing proposals to enable POS payments through a mobile banking application. For example, developing proposals for POS payments using QR codes that can be scanned through the company's mobile application.

Fig. 4 - Peer-to-peer systems simplify the payment experience of buyers

Area #4: Payment providers make life easier for merchants

This part is about the role of payment service providers (PSP), which mainly focus on aggregating payment methods and providing merchants with access to them.The payment services market for basic payment transaction processing services is developing rapidly. This is evidenced by the growing cost pressures facing hundreds of existing services. Staying on top of the ever-changing needs of buyers and sellers isn't easy. Payment aggregators are choosing different strategic paths to cope with changing market dynamics:

- Striving for leadership through global reach and scale, agility and backward integration

- Finding niches, offering best-in-class services for a specifically selected horizontal or vertical market and seller size.

- Explore options before, during and after the checkout phase of the purchasing process to deliver a comprehensive business proposition, as shown in Figure 5. Examples include PayPal's acquisition of iZettle and Adyen's acquisition of a banking license to increase omnichannel offerings for merchants.

There is also an entry into the market of new players who own diverse portfolios of services from various global payment services, that is, in fact, aggregators of such services. The services provided usually include optimized payment routing (selection of the most suitable payment service for a particular payment), visualization and analysis of key indicators.

Fig. 5 - Growth strategy - study of pre- and post-payment services before, during and after payment

Area #5: Mobile Revolution

The fifth area focuses on making mobile platforms a distinct payment channel. Mobile versions of banks have replaced browser-based ones as the preferred channel of interaction, as shown in Figure 6.The focus of users on mobile services has led to an increase in the number of competing banks paying special attention to mobile channels. Banks like N26, Revolut and Bunq do not have physical offices, providing almost all banking services exclusively through apps.

Fig. 6 - Traditional channels are being replaced by new, exclusively mobile channels

The next part of the translation examines online platforms (GAFA - Google, Apple, Facebook, Amazon and BAT - Baidu, Alibaba, Tencent), wallets, cryptocurrencies and new services.

We continue to understand the multi-layered infrastructure of the payment landscape. The first part was devoted to instant payment systems, payment platforms, online banking, payment acceptance services and the mobile revolution.

Today this means online platforms (Google, Apple, Facebook, Amazon + Baidu, Alibaba, Tencent), wallets, cryptocurrencies and new services. Let's start!

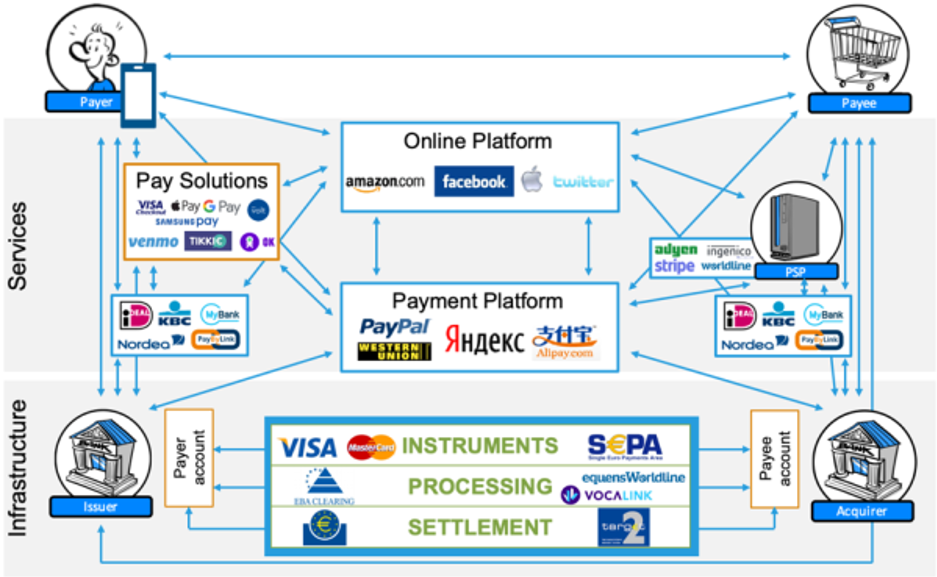

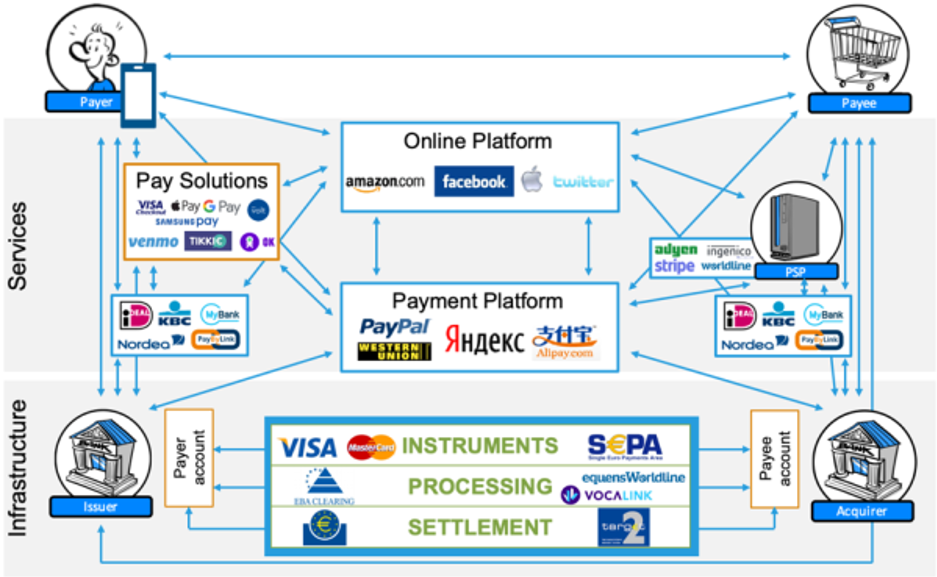

Area #6: Online Continents

This part is about the rise of online platforms (GAFA - Google, Apple, Facebook, Amazon and BAT - Baidu, Alibaba, Tencent) in terms of social interaction and commerce. Occupying an increasingly large part in every aspect of a consumer's life, these platforms offer their own dedicated payment solutions already integrated into their respective platforms, as shown in Figure 7.Globalization provides consumers with the ability to pay beyond their geographical borders. Online platforms offer services that make it easier to connect to payment systems outside the buyer's region (for example, Alipay offers its e-wallet to non-Chinese customers to simplify financial transactions in Chinese markets).

Presence in every aspect of a consumer's daily life provides a rich flow of data, allowing the creation of sophisticated payment solutions tailored to the customer's needs outside of the normal purchasing process. Providing payment services to its customers, in turn, gives the platform greater access to customer data and expands its ability to provide new value-added services.

Figure 7 - What position will online platforms take in the financial system and how will it affect the role and relevance of traditional payment institutions

Area #7: Payment solutions (wallets)

Previously, area 7 included wallets, the purpose of which was to simplify shopping. Recently, new payment solutions have appeared on the market, and wallets have new facets: they offer services to further support customers, not related to payments.The growth of P2P payments was relatively slow at first. Consumers were reluctant to pay for this type of service, comparing it to payments through OBEP or payment platforms, which are considered practically free. However, P2P payments are growing in popularity as service providers cut their own fees. This effect is achieved due to the fact that, as a marketing ploy, suppliers take on transaction costs and thereby stimulate users to switch to a new platform.

On the path to a profitable business model, service providers are looking to move their free B2C solutions into the C2B space by offering paid services to business clients. One example is US P2P payment solution Venmo (owned by PayPal), which began by absorbing transaction costs to build a user base. The company now earns revenue from purchases from approved online retailers, which are charged a commission.

PSD2 allows consumers to initiate payment from a licensed third-party application. This model is developing in the wallet direction, where in one application the buyer can pay from different accounts. However, the lack of standardization of PSD2 interfaces between banks at a European (and often national) level slows down the work of service providers wishing to offer such “wallet” solutions for payment accounts, as it increases the cost, complexity and implementation time to ensure high coverage. In an attempt to compensate for all these difficulties, various technical service providers are emerging who care about the possibility of such connectivity.

Recent developments in wallets are merging payments with non-payment services, such as in-app storage of loyalty and discount cards (eg OK and Reward Cards). This further simplifies the consumer experience beyond payments. Such developments in the field of non-payment services are revealed in the 9th area.

Figure 8 - Payment solutions go beyond card payments while simplifying processes

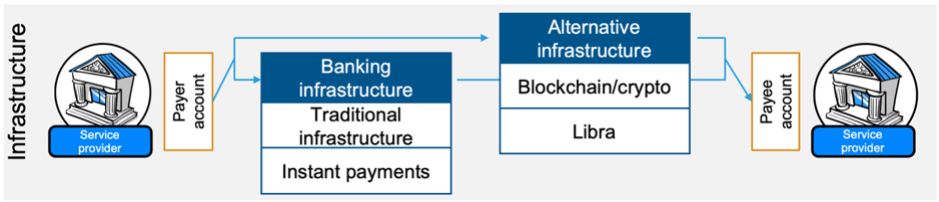

Area 8: Alternative payment infrastructure

The evolution of the payments landscape described in Areas 2–7 has always looked to the traditional infrastructure from Area 1 as the foundation for innovation. Currently, the payment infrastructure itself is subject to innovation and faces potential threats. While traditional players are pioneering new infrastructure initiatives such as instant payments and exploring the opportunities that technologies like blockchain can bring to the financial system, non-traditional players are also exploring infrastructure developments that could greatly impact the traditional financial system.Non-traditional players are introducing alternatives to the existing payment infrastructure, creating a system in which service providers exchange valuable information on behalf of the payer and recipient across various payment infrastructures (as shown in Figure 9). All this happens for several reasons: for example, to reduce dependence on traditional financial players, benefit from existing functionality and increase the speed of innovation.

Figure 9 - The infrastructure is managed by "service providers" in the payer and recipient area (as opposed to traditional issuers and acquirers)

Alternative payment infrastructure based on blockchain and cryptocurrency has been around for several years. It has proven useful on occasion (such as the recent hyperinflation of Venezuela's national currency), but its general acceptance as a payment mechanism for everyday purposes has been slow. As a recent example, consider the Libra consortium, an alternative payments infrastructure that is currently under scrutiny by governments and central banks due to its disruptive potential for the traditional financial system (along with security and governance issues). At the same time, regulators are also developing their own alternative infrastructure projects. Thus, in response to the introduction of Libra, the National Bank of China is accelerating the development of the digital yuan (DECP). DECP offers "controlled" anonymity and functionality to replace paper money. Opinions vary on the viability of alternative payment infrastructures and the demand for them, and we are expected to see real potential for such infrastructures in the near future.

Area 9: Alternative Services

Traditional payment infrastructure is the basis of many payment services. But in the end, all this variety comes down to a traditional payment like SCT or card payment.In search of new business models, financial institutions have found new uses for their payments infrastructure. Their interconnected network of trusted and regulated organizations specializing in the exchange of structured data proves useful for various types of services beyond payments.

Examples of how existing payments infrastructure can be used for other applications and services include transferring personal registration or login data through third-party applications (for example, BankID schemes), and combining payments with other data streams, such as e-invoicing or loyalty and discount schemes. Other alternative services include lending services offered to both consumers (eg Payu) and businesses (eg PayPal). By using the payment history of buyers and sellers for profiling and scoring, players like Amazon and Paypal can provide instant lending services to facilitate payment transactions.

By accelerating these processes, PSD2 simplifies access to payment infrastructure for non-financial institutions and ensures seamless integration of payment systems with alternative services.

Figure 10 - Emergence of alternative services in addition to existing services and infrastructure

A look into the future

The integration of payment services with alternative structures and data sources is the result of the development of interconnections in the digital world. Although this technology can hardly be called new, hosting financial systems services via APIs has gained great popularity in recent years. Automated, real-time access to data and services has significantly improved the products and services of both financial and non-financial players.PSD2 is a key factor in the development of several of the described regions. Recent years for PSD2 have been spent in discussions about technology standards and have delayed the implementation of regulatory technology standards. A key theme of PSD2 is Strong Customer Authentication (SCA), which impacts a variety of purchasing scenarios. The next decade will tell whether the innovative potential of PSD2 will be realized.

The financial system in Europe is still heavily dependent on traditional card schemes and is under increasing pressure from tech giants (GAFA and BAT) as they try to expand their influence. The global payments landscape is truly undergoing a transformation. Major technological advances, regulatory reforms and increasingly new initiatives coming from global digital platforms in particular have led to significant changes. These developments put significant pressure on banks and payment services to take action.

Finally, one interesting recent development worth following is the launch of PEPSI (Pan-European Payment Systems Initiative). PEPSI is an initiative aimed at developing a pan-European retail payments solution that can compete with card schemes and tech giants. It is supported by the twenty largest European banks, as well as the ECB. In the future, this initiative could be an important development that will influence the further development of the payments landscape. However, an important success factor will be whether the players involved are willing to take an organized and collaborative approach to creating a pan-European alternative for domestic (card) payment schemes across Europe.

(c) Original author: Anda Kania