Brother

Professional

- Messages

- 2,590

- Reaction score

- 526

- Points

- 113

China is struggling with the leakage of hundreds of billions of dollars of capital through illegal casinos and crypto exchanges.

A new report from the United Nations Office on Drugs and Crime (UNODC) states that international criminal networks are using autonomous territories controlled by armed groups in Southeast Asia to host physical and online casinos, which, together with crypto exchanges, have led to an increase in money laundering and cyber fraud. and cybercrime in the region and beyond.

The report notes that casinos have long been used for money laundering. This is one of the reasons why China banned them in 1949. But until recently, China's Macau Special Administrative Region, a former Portuguese colony, was home to the world's largest gambling hub, surpassing even Las Vegas.

Most of the cash circulating in Macau came from junket tour operators, entities that organized all-inclusive trips to various casinos for big players. Junket tour operators received commissions from casinos and sometimes even offered loans to players or collected debts. China considered that junket tour operators were contributing to crime and banned the recruitment of citizens to travel to Macau, and then prosecuted two of the most prominent junket tour operators.

The UN report claims that after the Chinese ban, junket tour operators began to cooperate with illegal casinos or operate them in poorly regulated jurisdictions, including Cambodia, Laos and the Philippines, as well as several border areas controlled by armed groups in Myanmar. The report also states that some organized criminal groups operate illegal online casinos in the UAE, Africa, Eastern Europe and the Pacific.

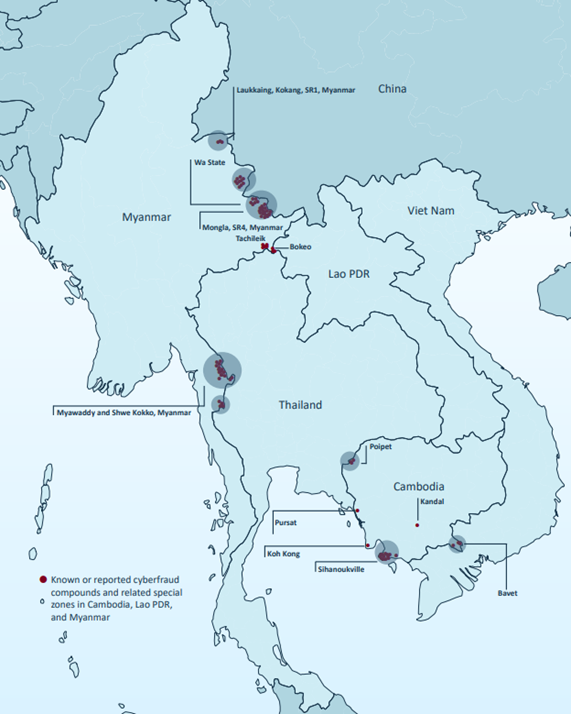

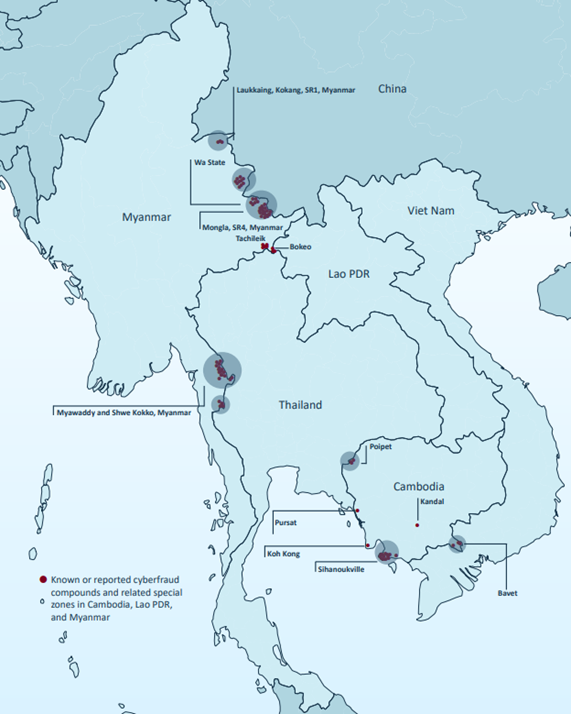

Geographical locations of gambling zones in the Asian region

According to the report, the focus of software-as-a-service (SaaS) providers on the gambling industry means that it is now very easy to create an online casino with limited technical expertise and capital, regardless of gambling laws in a given jurisdiction. The proliferation of third-party payment providers, e-wallets, and other payment solutions also meant that junketeers turned casino operators and money launderers had plenty of options when they launched their illegal sites.

Illegal casinos, in turn, "have become one of the most popular tools for laundering cryptocurrency," especially for those people who use Tether or USDT on the TRON blockchain.

Money laundering requires a network of fake accounts and the people who manage them. The report cites Chinese data that showed that there are at least 5 million participants in the underground industry, which has a total volume of about $157 billion. in the form of capital outflow.

Illegal casinos also need money laundering, because many of them have expanded their operations and run gangs of cyber scammers who enslave people to carry out scams. The UN report suggests that for this reason, groups are diversifying their business model, expanding at the expense of:

The UN report calls on Asian governments to understand the scale and cunning of criminals operating online casinos and related money laundering operations.

Casinos and related high-cash businesses have long been vehicles for underground banking and money laundering, but the rise of under-regulated online gambling platforms and crypto exchanges has changed the game. Organized crime groups converge where they see vulnerabilities, and casinos and cryptocurrencies have proven to be the point of least resistance.

A new report from the United Nations Office on Drugs and Crime (UNODC) states that international criminal networks are using autonomous territories controlled by armed groups in Southeast Asia to host physical and online casinos, which, together with crypto exchanges, have led to an increase in money laundering and cyber fraud. and cybercrime in the region and beyond.

The report notes that casinos have long been used for money laundering. This is one of the reasons why China banned them in 1949. But until recently, China's Macau Special Administrative Region, a former Portuguese colony, was home to the world's largest gambling hub, surpassing even Las Vegas.

Most of the cash circulating in Macau came from junket tour operators, entities that organized all-inclusive trips to various casinos for big players. Junket tour operators received commissions from casinos and sometimes even offered loans to players or collected debts. China considered that junket tour operators were contributing to crime and banned the recruitment of citizens to travel to Macau, and then prosecuted two of the most prominent junket tour operators.

The UN report claims that after the Chinese ban, junket tour operators began to cooperate with illegal casinos or operate them in poorly regulated jurisdictions, including Cambodia, Laos and the Philippines, as well as several border areas controlled by armed groups in Myanmar. The report also states that some organized criminal groups operate illegal online casinos in the UAE, Africa, Eastern Europe and the Pacific.

Geographical locations of gambling zones in the Asian region

According to the report, the focus of software-as-a-service (SaaS) providers on the gambling industry means that it is now very easy to create an online casino with limited technical expertise and capital, regardless of gambling laws in a given jurisdiction. The proliferation of third-party payment providers, e-wallets, and other payment solutions also meant that junketeers turned casino operators and money launderers had plenty of options when they launched their illegal sites.

Illegal casinos, in turn, "have become one of the most popular tools for laundering cryptocurrency," especially for those people who use Tether or USDT on the TRON blockchain.

Money laundering requires a network of fake accounts and the people who manage them. The report cites Chinese data that showed that there are at least 5 million participants in the underground industry, which has a total volume of about $157 billion. in the form of capital outflow.

Illegal casinos also need money laundering, because many of them have expanded their operations and run gangs of cyber scammers who enslave people to carry out scams. The UN report suggests that for this reason, groups are diversifying their business model, expanding at the expense of:

- development of malicious mobile and web applications or malware;

- broader blockchain gaming industry (including metaverse casinos);

- online banking fraud schemes;

- exchange of cryptocurrencies;

- payment services;

- custom cybercrime services (Cybercrimes-as-a-Service, CaaS).

The UN report calls on Asian governments to understand the scale and cunning of criminals operating online casinos and related money laundering operations.

Casinos and related high-cash businesses have long been vehicles for underground banking and money laundering, but the rise of under-regulated online gambling platforms and crypto exchanges has changed the game. Organized crime groups converge where they see vulnerabilities, and casinos and cryptocurrencies have proven to be the point of least resistance.