Carding Forum

Professional

- Messages

- 2,788

- Reaction score

- 1,297

- Points

- 113

Modern biometric identification methods use different techniques: from heartbeat to voice recognition. But the most popular is the fingerprint.

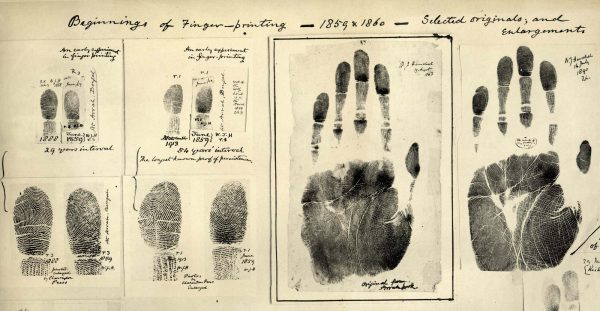

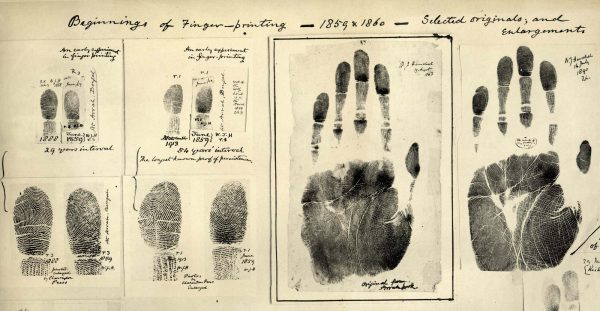

The origins of biometric authentication.

Fingerprints were originally used to identify criminals. This method was first used in Indian forensics in the middle of the 19th century. And already in 1902 it was used in Denmark to identify a criminal. Editorial PaySpace Magazine has collected modern biometric identification methods that are used in the financial sector, most often to confirm the payment.

Modern biometric methods of personal identification: TOP-5

Method number 1

The most popular service that uses a fingerprint to verify a payment is Apple Pay. The service was launched in October 2014. Today it is available on all modern Apple phones, starting with the iPhone 6. The fingerprint scanner is located under a single button on the front of the smartphone. All you need to confirm the transaction is to click on it.

A fingerprint can serve not only as a password, but also as a full-fledged payment tool. WorldPay offers to install scanners in supermarkets and directly bind a fingerprint to a bank card. Customers will be able to pay for goods with one touch.

Method number 2

The voice recognition system is being actively implemented in call-centers of banks. This authentication model allows you to verify the identity of the caller without a code word that is often forgotten. To do this, the system refers to the bank's archive and compares the caller's voice with the original, which was recorded during the opening of the account.

This system is already used in various banks around the world - from North America to Hong Kong.

An interesting format for using voice was offered by Wells Fargo, the largest bank in the United States. As part of the experiment, users of the mobile application were asked to test voice identification for entering mobile banking.

[B2]Method number 3[/B]

This identification can be done both online and in a traditional store. Finnish startup Uniqul proposed a similar system back in 2013. She scans the face of the buyer at the checkout of the store, verifies it with the original in the database and transmits the payment data for payment. In this case, the user does not even need to take out the wallet. The details of his card are stored in the system. The same technology was tested by the Japanese corporation NEC.

A face recognition ATM has already been created in China. And Mastercard has launched selfie payments in Europe, the United States and other countries. Apple's latest smartphone, the iPhone X, also boasts this functionality.

Method number 4

The Japanese smartphone maker Fujitsu in the summer of 2015 offered a system that allows you to pay for purchases by sight. A scanner appeared in mobile phones that turned the retina into a password.

And the British Railways will scan the retina of the passenger's eye to let him go on the desired flight.

Method number 5

The rhythm of the heartbeats is also unique. He, like fingerprints, is almost impossible to repeat. Modern fitness bracelets are capable of recognizing electrocardiographic signals. Several electronics manufacturers have already seen the potential of their devices in banking.

For example, the Canadian manufacturer Bionym is testing the Nymi bracelet together with the British bank Halifax. A unique heart rate indicator is used to access internet banking. The device also provides payment functionality.

PAYSPACE MAGAZINE HELP

We previously reported that 56% of Internet users in the UK prefer to use biometric authentication methods over traditional digital banking passwords. Pomimimo following methods to confirm the identity can be used to read the veins on his arm, behavior analysis, brain signals, and even scan the ears.

SURVEY - What biometrics are suitable for finance?

The origins of biometric authentication.

Fingerprints were originally used to identify criminals. This method was first used in Indian forensics in the middle of the 19th century. And already in 1902 it was used in Denmark to identify a criminal. Editorial PaySpace Magazine has collected modern biometric identification methods that are used in the financial sector, most often to confirm the payment.

Modern biometric methods of personal identification: TOP-5

Method number 1

The most popular service that uses a fingerprint to verify a payment is Apple Pay. The service was launched in October 2014. Today it is available on all modern Apple phones, starting with the iPhone 6. The fingerprint scanner is located under a single button on the front of the smartphone. All you need to confirm the transaction is to click on it.

A fingerprint can serve not only as a password, but also as a full-fledged payment tool. WorldPay offers to install scanners in supermarkets and directly bind a fingerprint to a bank card. Customers will be able to pay for goods with one touch.

Method number 2

The voice recognition system is being actively implemented in call-centers of banks. This authentication model allows you to verify the identity of the caller without a code word that is often forgotten. To do this, the system refers to the bank's archive and compares the caller's voice with the original, which was recorded during the opening of the account.

This system is already used in various banks around the world - from North America to Hong Kong.

An interesting format for using voice was offered by Wells Fargo, the largest bank in the United States. As part of the experiment, users of the mobile application were asked to test voice identification for entering mobile banking.

[B2]Method number 3[/B]

This identification can be done both online and in a traditional store. Finnish startup Uniqul proposed a similar system back in 2013. She scans the face of the buyer at the checkout of the store, verifies it with the original in the database and transmits the payment data for payment. In this case, the user does not even need to take out the wallet. The details of his card are stored in the system. The same technology was tested by the Japanese corporation NEC.

A face recognition ATM has already been created in China. And Mastercard has launched selfie payments in Europe, the United States and other countries. Apple's latest smartphone, the iPhone X, also boasts this functionality.

Method number 4

The Japanese smartphone maker Fujitsu in the summer of 2015 offered a system that allows you to pay for purchases by sight. A scanner appeared in mobile phones that turned the retina into a password.

And the British Railways will scan the retina of the passenger's eye to let him go on the desired flight.

Method number 5

The rhythm of the heartbeats is also unique. He, like fingerprints, is almost impossible to repeat. Modern fitness bracelets are capable of recognizing electrocardiographic signals. Several electronics manufacturers have already seen the potential of their devices in banking.

For example, the Canadian manufacturer Bionym is testing the Nymi bracelet together with the British bank Halifax. A unique heart rate indicator is used to access internet banking. The device also provides payment functionality.

PAYSPACE MAGAZINE HELP

We previously reported that 56% of Internet users in the UK prefer to use biometric authentication methods over traditional digital banking passwords. Pomimimo following methods to confirm the identity can be used to read the veins on his arm, behavior analysis, brain signals, and even scan the ears.

SURVEY - What biometrics are suitable for finance?