Tomcat

Professional

- Messages

- 2,688

- Reaction score

- 1,015

- Points

- 113

Thanks to the rapid progress in the banking sector towards digitalization and an increase in the range of banking services, the client’s comfort is constantly increasing and the possibilities are expanding. But at the same time, the risks increase, and, accordingly, the level of requirements for ensuring the security of the client’s finances increases.

The annual loss from financial fraud in the field of online payments is approximately $200 billion. 38% of them are the result of theft of user personal data. How to avoid such risks? Antifraud systems help with this.

A modern anti-fraud system is a mechanism that allows, first of all, to understand the behavior of each client in all banking channels and track it in real time. It can detect both cyber threats and financial fraud.

It should be noted that defense often lags behind attack, so the goal of a good anti-fraud system is to reduce this lag to zero and ensure timely detection and response to emerging threats.

Today, the banking sector is gradually updating its fleet of outdated anti-fraud systems with new ones, which are created using new and improved approaches, methods and technologies, such as:

efficiency, without requiring significant additional resources.

The use of machine learning and artificial intelligence, information from financial

cybersecurity analytical centers reduces the need for a large staff

of highly qualified specialists and makes it possible to significantly increase the speed and

accuracy of event analysis.

Together with the use of long-term behavioral biometrics, it is possible to detect “zero-day attacks” and minimize the number of false positives. The anti-fraud system must provide a multi-level approach to ensuring transaction security (end device – session – channel – multi-channel protection – use of data from external SOCs). Security should not end with user authentication and transaction integrity verification.

A high-quality modern anti-fraud system allows you not to disturb the client when there is no need for it, for example, by sending him a one-time password to confirm entry into his personal account. This improves his experience in using the bank’s services and, accordingly, ensures partial self-sufficiency, while significantly increasing the level of trust. It should be noted that the anti-fraud system is a critical resource, since stopping its operation can lead either to a stop in the business process, or, if the system does not work correctly, to an increase in the risk of financial losses. Therefore, when choosing a system, you should pay attention to operational reliability, data storage security, fault tolerance, and system scalability.

An important aspect is also the ease of deployment of the anti-fraud system and the ease of its

integration with the bank’s information systems. At the same time, you need to understand that

integration should be the minimum necessary, since it can affect the speed and

efficiency of the system.

For experts’ work, it is very important that the system has a user-friendly interface and makes it possible to obtain the most detailed information about an event. Setting up scoring rules and actions should be easy and simple.

Today there are a number of well-known solutions on the anti-fraud systems market:

analytical platforms. The system allows you to detect fraud attempts in real time and monitors transactions after the user logs into the system, which allows you to protect against MITM (Man in the Middle) and MITB (Man in the Browser) attacks.

The choice of an anti-fraud system should be made, first of all, with an understanding of your needs: it should be an analytical platform for identifying financial fraud, a solution for protecting cyber threats, or a comprehensive solution that provides both. A number of solutions can be integrated with each other, but often a single system that allows us to solve the problems we face will be most effective.

Author: Artemy Kabantsov

The annual loss from financial fraud in the field of online payments is approximately $200 billion. 38% of them are the result of theft of user personal data. How to avoid such risks? Antifraud systems help with this.

A modern anti-fraud system is a mechanism that allows, first of all, to understand the behavior of each client in all banking channels and track it in real time. It can detect both cyber threats and financial fraud.

It should be noted that defense often lags behind attack, so the goal of a good anti-fraud system is to reduce this lag to zero and ensure timely detection and response to emerging threats.

Today, the banking sector is gradually updating its fleet of outdated anti-fraud systems with new ones, which are created using new and improved approaches, methods and technologies, such as:

- working with large amounts of data;

- machine learning;

- artificial intelligence;

- long-term behavioral biometrics

- and others.

efficiency, without requiring significant additional resources.

The use of machine learning and artificial intelligence, information from financial

cybersecurity analytical centers reduces the need for a large staff

of highly qualified specialists and makes it possible to significantly increase the speed and

accuracy of event analysis.

Together with the use of long-term behavioral biometrics, it is possible to detect “zero-day attacks” and minimize the number of false positives. The anti-fraud system must provide a multi-level approach to ensuring transaction security (end device – session – channel – multi-channel protection – use of data from external SOCs). Security should not end with user authentication and transaction integrity verification.

A high-quality modern anti-fraud system allows you not to disturb the client when there is no need for it, for example, by sending him a one-time password to confirm entry into his personal account. This improves his experience in using the bank’s services and, accordingly, ensures partial self-sufficiency, while significantly increasing the level of trust. It should be noted that the anti-fraud system is a critical resource, since stopping its operation can lead either to a stop in the business process, or, if the system does not work correctly, to an increase in the risk of financial losses. Therefore, when choosing a system, you should pay attention to operational reliability, data storage security, fault tolerance, and system scalability.

An important aspect is also the ease of deployment of the anti-fraud system and the ease of its

integration with the bank’s information systems. At the same time, you need to understand that

integration should be the minimum necessary, since it can affect the speed and

efficiency of the system.

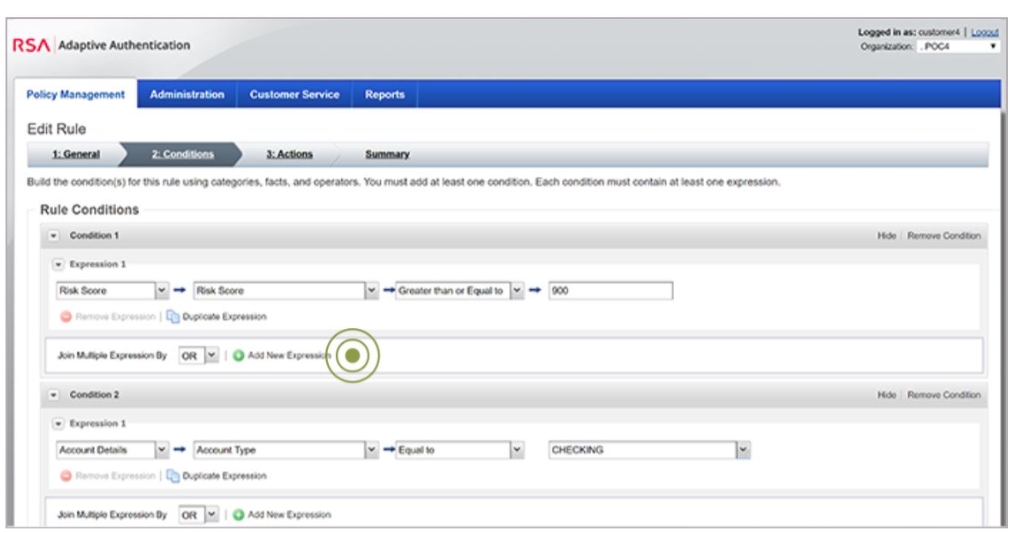

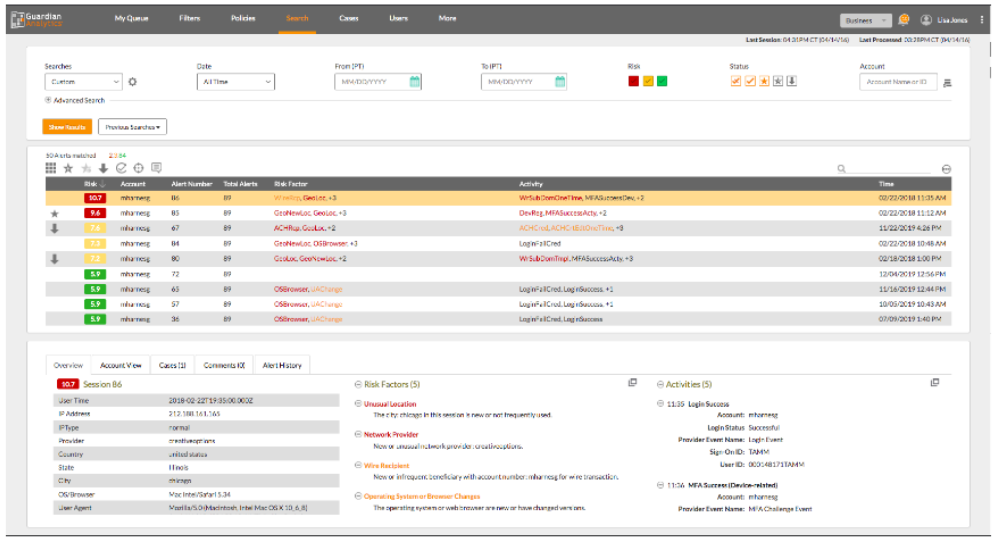

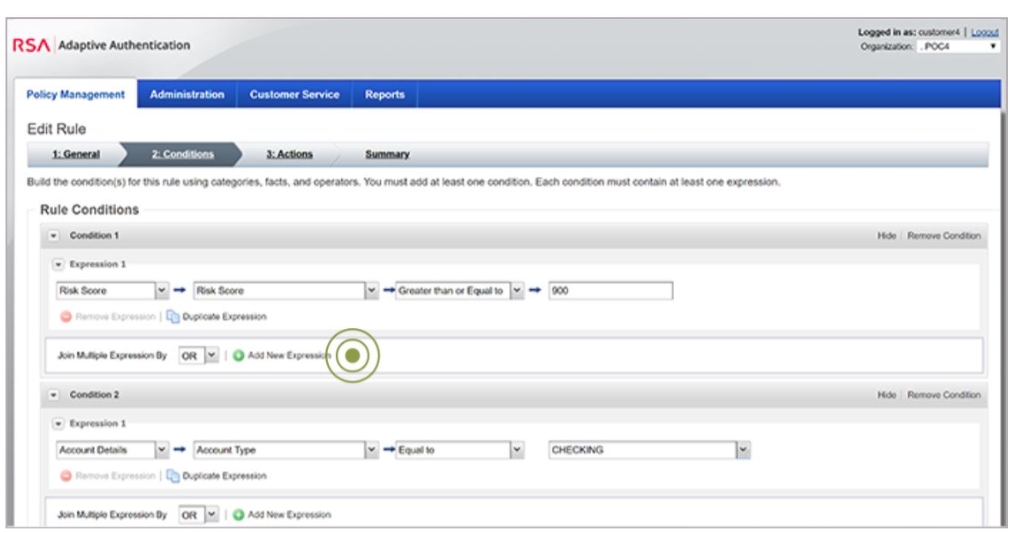

For experts’ work, it is very important that the system has a user-friendly interface and makes it possible to obtain the most detailed information about an event. Setting up scoring rules and actions should be easy and simple.

Today there are a number of well-known solutions on the anti-fraud systems market:

ThreatMark

The AntiFraudSuite solution from ThreatMark, despite being quite young on the antifraud systems market, managed to come to the attention of Gartner. AntiFraudSuite includes the ability to detect cyber threats and financial fraud. The use of machine learning, artificial intelligence and long-term behavioral biometrics allows you to identify threats in real time and has a very high detection accuracy.

NICE

The Nice Actimize solution from NICE belongs to the class of analytical platforms and allows for the detection of financial fraud in real time. The system provides security for all types of payments, including SWIFT/Wire, Faster Payments, BACS SEPA payments, ATM/Debit transactions, Bulk payments, Bill payments, P2P/postal payments and various forms of domestic transfers.RSA

RSA Transaction Monitoring and Adaptive Authentication from RSA belongs to the class ofanalytical platforms. The system allows you to detect fraud attempts in real time and monitors transactions after the user logs into the system, which allows you to protect against MITM (Man in the Middle) and MITB (Man in the Browser) attacks.

SAS

SAS Fraud and Security Intelligence (SAS FSI) is a single platform for solving the problems of preventing transactional, credit, internal and other types of financial fraud. The solution combines fine-tuning of business rules with machine learning technologies to prevent fraud with a minimum level of false positives. The system includes built-in integration mechanisms with online and offline data sources.

F5

F5 WebSafe is a solution to protect against cyber threats in the financial sector from F5. It allows you to detect account theft, signs of malware infection, keylogging, phishing, remote access Trojans, as well as MITM (Man in the Middle), MITB (Man in the Browser) and MITP (Man in the Phone) attacks ).

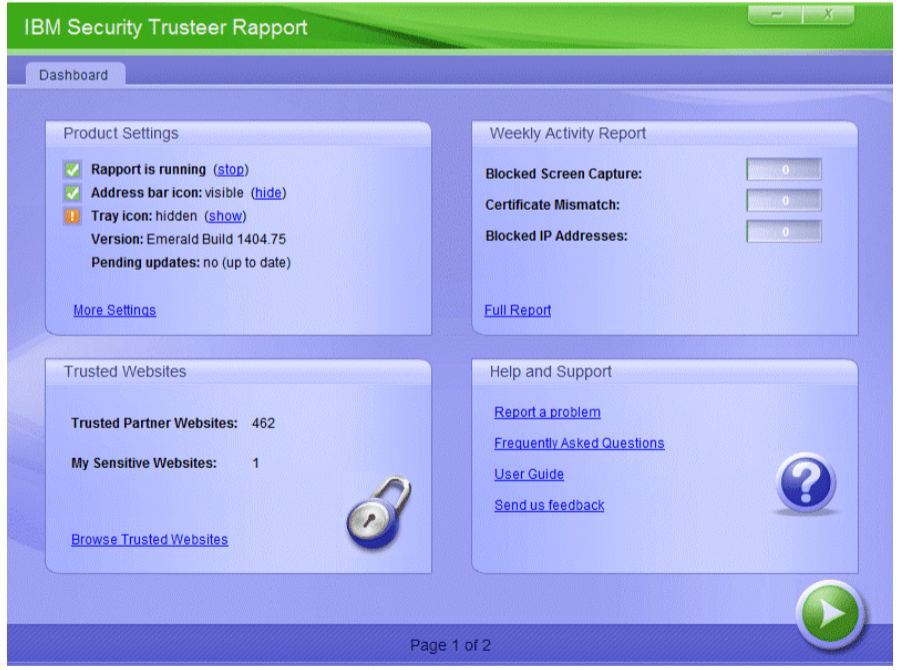

IBM

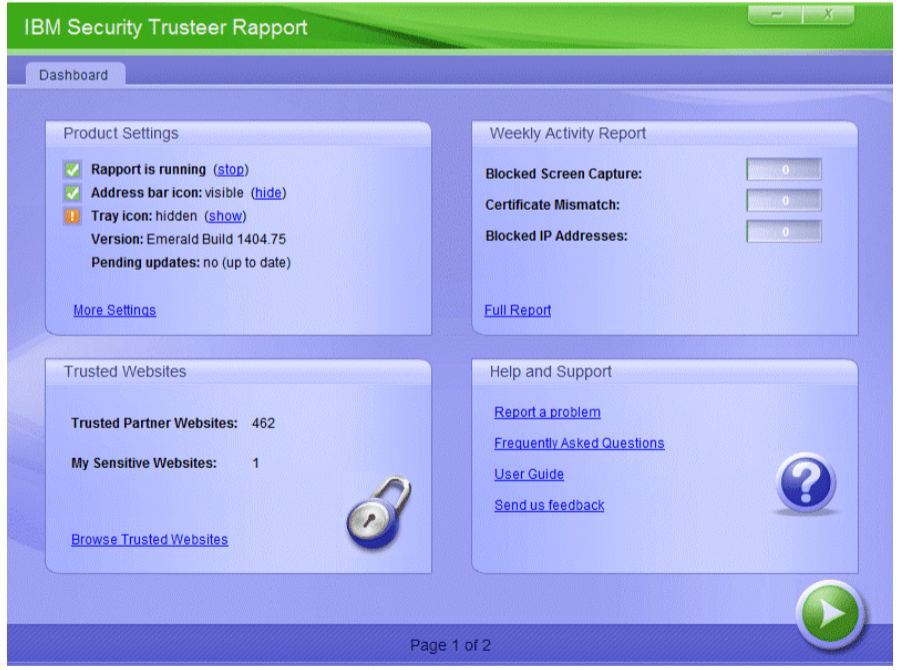

IBM Trusteer Rapport from IBM is designed to protect users from credential sniffing, screen capture, malware and phishing attacks, including MITM (Man in the Middle) and MITB (Man in the Browser) attacks. To achieve this, IBM Trusteer Rapport uses machine learning technologies to automatically detect and remove malware from the end device, ensuring a secure online session.

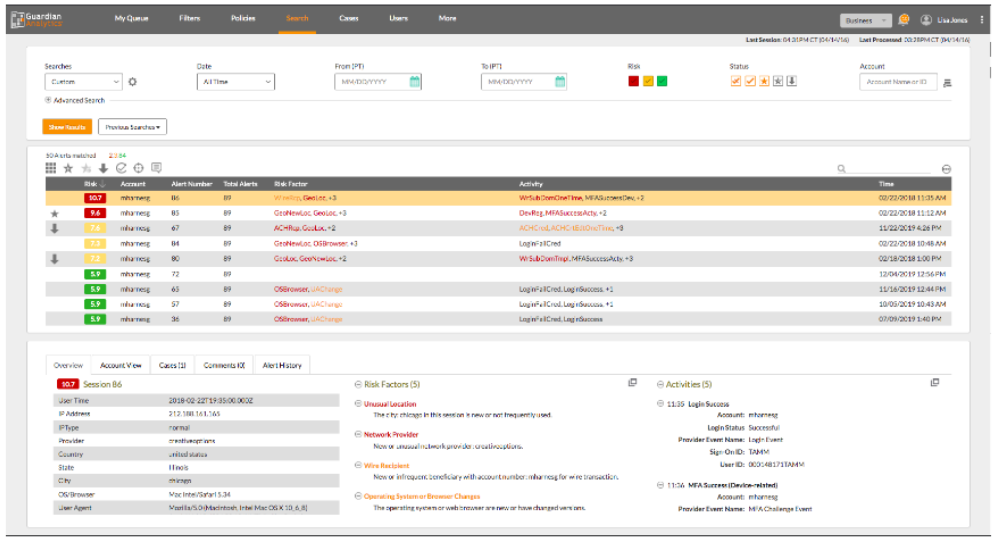

Guardian Analytics

The Digital Banking Fraud Detection system from Guardian Analytics is an analytical platform. At the same time, Digital Banking Fraud Detection protects against attempts to take over a client’s account, fraudulent transfers, phishing and MITB (Man in the Browser) attacks in real time. For each user, a profile is created, on the basis of which abnormal behavior is recognized.

The choice of an anti-fraud system should be made, first of all, with an understanding of your needs: it should be an analytical platform for identifying financial fraud, a solution for protecting cyber threats, or a comprehensive solution that provides both. A number of solutions can be integrated with each other, but often a single system that allows us to solve the problems we face will be most effective.

Author: Artemy Kabantsov